How to Permanently Close Your SBI Account: A Step-by-Step Guide

Are you considering closing your State Bank of India (SBI) account? Whether it’s due to a move, dissatisfaction with services, or simply a change in financial management, closing your account is a straightforward process. In this blog, we will tell you how you can close your SBI account very easily.

1. Understand the Reasons for Closing Your Account

Before making any decisions, it’s important to consider why you want to close your account. Make sure you have explored all options, such as switching to a different account type, you are not satisfied with SBI customer service, or your branch is at your doorstep.

2. Clear Outstanding Dues

Before closing your account, make sure you clear any outstanding dues or pending transactions. This includes:

- Pending checks

- Automatic payments or direct debits

- Loans linked to the account

3. Withdraw Your Funds

There should not be any negative amount in your account, if there is a balance in your account then you can transfer it to any other account or take cash. Ensure that the balance is zero before you proceed to close the account.

4. Gather Required Documents

To close your SBI account, you will need to provide some documents, including:

- Account closure form (available at the branch or online) Click here to download SBI Account Closer form

- A valid ID proof (Aadhaar Card, PAN card, Voter ID, Passport, etc.)

- A passport-sized photograph

- A self-attested copy of your passbook or bank statement

5. Fill Out the Account Closure Form

Download and print the account closure form, or it will be available in the bank also. Fill in the correct details in the account closure form and ensure that no details are wrong to avoid delay.

6. Submit the Form and Documents

Hand over the completed form along with your ID proof, photograph, and any other required documents to the bank officer. They will verify the details.

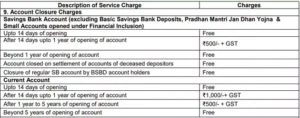

7. SBI Account Closing Charges

For current accounts, the charge will be Rs 1,000 plus GST for tenure from 14 days to 1 year after account opening, and Rs 500 plus GST for tenure from 1 year to 5 years following account opening.

8. Request Confirmation

After processing your request, ask for a confirmation of account closure. This may come in the form of a letter or an email. Keep this confirmation for your records.

9. Destroy Your Cheque Book and Debit Card

For security reasons, destroy any remaining checkbooks and debit cards associated with your closed account. This prevents unauthorized access.

10. Monitor Your Account Closure

After a few days, check with the bank to ensure your account has been closed successfully. You can also verify by attempting to access your online banking.

11. How to close an SBI account online

State Bank of India does not provide an online facility to close the account, the only way to close the account is by visiting the bank.

Conclusion

Closing your SBI account doesn’t have to be a daunting task. By following these steps, you can ensure a smooth and hassle-free process. Always keep a record of your closure confirmation and stay vigilant to protect your financial information. If you have any concerns or need assistance, don’t hesitate to reach out to SBI customer service for support.