Future Outlook of Cochin Shipyard Share Price: 2024-2040

Cochin Shipyard Ltd (CSL) has been a significant player in India’s maritime sector, and as investors look toward the future, understanding the potential trajectory of its share price becomes crucial. In this blog, we’ll explore the anticipated share price for Cochin Shipyard from 2024 through 2040, considering various economic, technological, and industry trends.

What is Cochin Shipyard Ltd (CSL)?

The company constructs all kinds of ships and also does repairs, upgrades, maintenance, and life extension. They also repair and maintain aircraft carriers and other defense ships, as well as tankers, cargo ships, and specialized vessels.

Current Status and Recent Performance

Before diving into projections, it’s essential to evaluate the current market performance of Cochin Shipyard. As of late 2023, CSL has demonstrated resilience amidst market fluctuations, driven by increased demand for shipbuilding and repair services, government initiatives, and a growing focus on maritime sustainability.

Factors Influencing Future Share Prices

- Government Policies and Initiatives: The Indian government’s push for the “Make in India” initiative, along with policies favoring indigenous shipbuilding, could significantly impact CSL’s performance. The implementation of policies supporting renewable energy and defense projects will also play a pivotal role.

- Global Maritime Trends: The maritime industry is evolving with advancements in technology, sustainability practices, and changes in global trade dynamics. Cochin Shipyard’s ability to adapt to these changes will be crucial for its growth.

- Financial Performance: Key financial indicators such as revenue growth, profit margins, and return on equity will heavily influence share price movements. Regular analysis of quarterly earnings will be vital.

- Competition: The competitive landscape, including domestic and international players, will affect CSL’s market share and pricing power. Strategic partnerships and expansions will be critical to maintaining a competitive edge.

- Technological Advancements: Innovations in shipbuilding technologies, including automation and eco-friendly practices, can enhance efficiency and reduce costs, thereby positively impacting profitability.

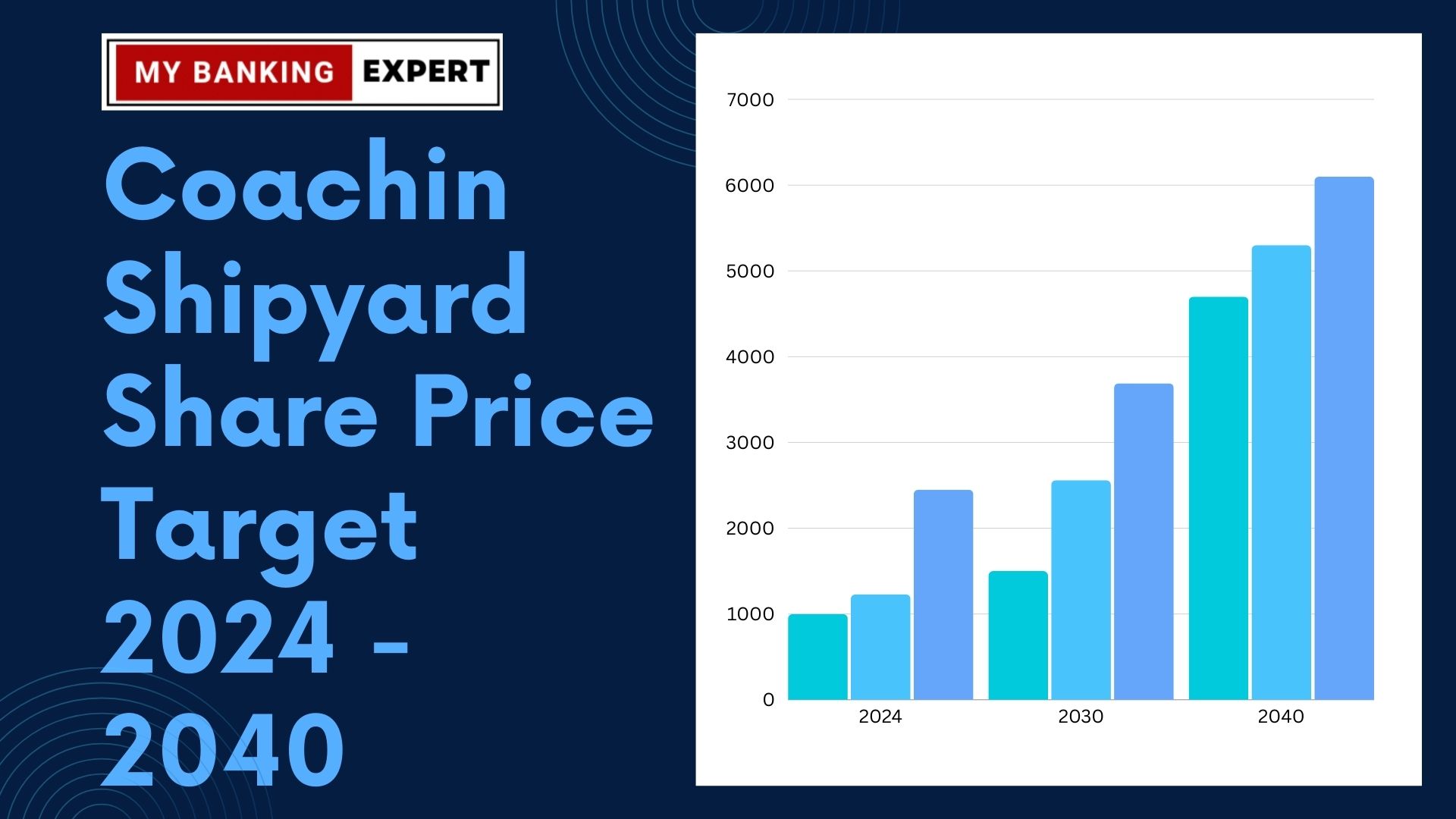

Projected Share Prices

Based on the above factors, here’s a speculative outlook on Cochin Shipyard’s share price for the years 2024 to 2040:

- 2024: ₹625 – ₹2500

- From 2023, many Indian stocks, including COCHINSHIP, have shown a positive trend. This upward trend is expected to continue in 2024. The share prices of Cochin Shipyard have been growing very quickly since 2022. If this continues, investors can expect very good returns.

- 2025: ₹2250 – ₹3750

- Cochin Shipyard Limited works with both private companies and the government. After starting to work with the government, their profit and the number of projects they have both increased. This company builds ships and shipyards. Since 2022, their share price has gone up very quickly. If the shares of Cochin Shipyard keep rising like this, by 2025, investors can expect very good returns.

- 2026: ₹3200 – ₹4500

- A potential bounce as new projects commence reflects strong demand in the shipbuilding sector. Whose share will get higher year after year.

- 2027: ₹4000 – ₹5400

- With the expansion of operational capacity and successful completion of the project, investor confidence may increase. This means that the shares of the company are going from higher to higher levels.

- 2028: ₹4800 – ₹6250

- An increase in international orders, Participation in government schemes, and successful diversification into maritime services could significantly increase the share price.

- 2030: ₹8,500 – ₹10,300

- By this time, CSL could be a key player in sustainable shipbuilding, attracting new investments and partnerships.

- 2035: ₹15,500 -₹18,800

- With consistent growth and market leadership, the share price can reflect the company’s established position in the industry. Whose face reflects new heights in the company.

- 2040: ₹22,500 – ₹30,400

- A long-term vision focusing on global competitiveness and innovation could lead to substantial gains, making CSL a heavyweight in the maritime sector.

Conclusion

While these projections are speculative, they reflect the potential trajectory of Cochin Shipyard’s share price based on current trends and anticipated developments. Investors should remain vigilant, continuously monitoring the company’s performance, industry trends, and economic conditions.

Investing in stocks requires careful consideration and due diligence; hence, it’s advisable to consult financial advisors and conduct thorough research before making investment decisions. The maritime industry is poised for growth, and Cochin Shipyard is well-positioned to capitalize on emerging opportunities in the coming decades.

Disclaimer

This blog is for informational purposes only and should not be considered financial advice. Always conduct your research and consult with a financial advisor before making investment decisions.